This window allows the user to define GL accounts for your loan transactions for each product.

How you define different General Ledger accounts

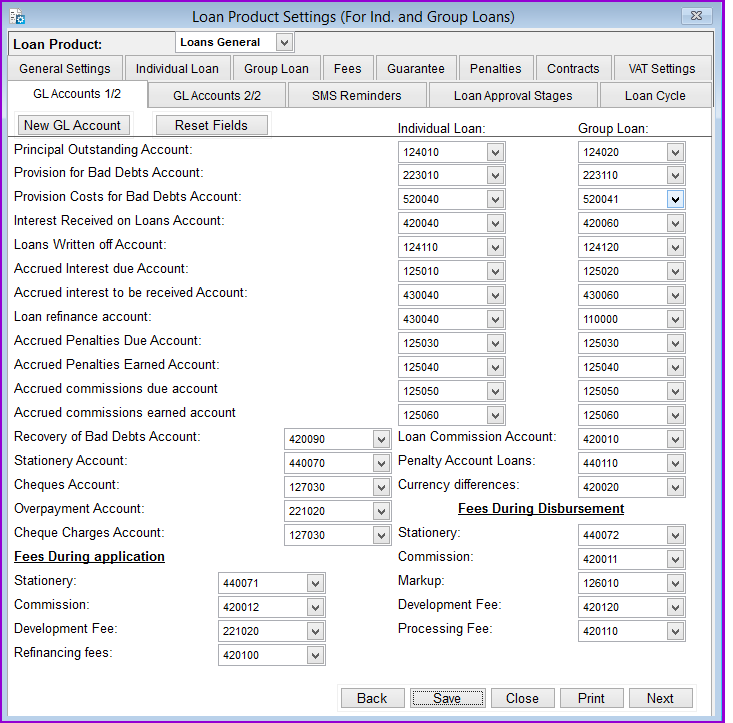

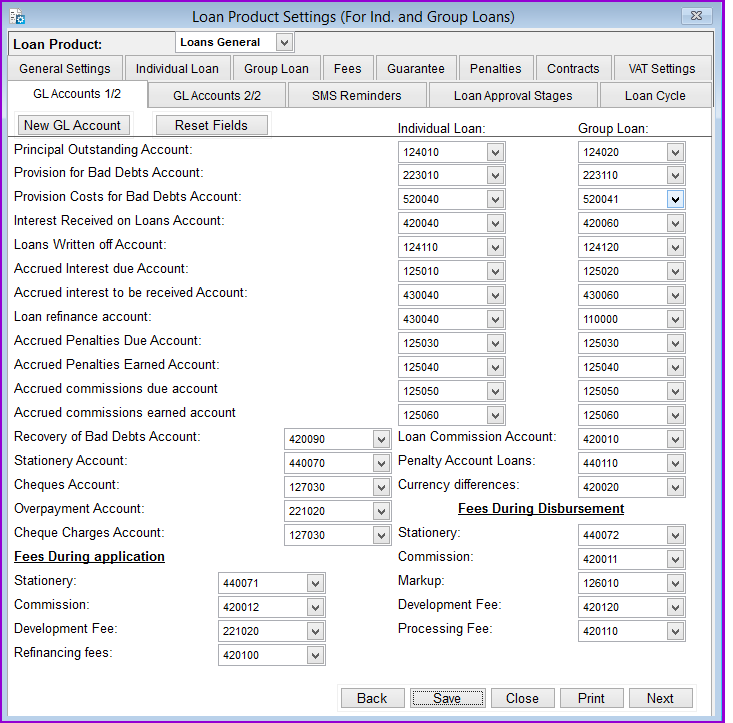

To define and assign different General Ledger accounts go to System/Configuration/Loan Product Settings/GL Accounts 1-2 Settings and the following screen appears:

Note that the stationery fees will be booked on this GL account specified above. It is similar to the GL account down that you will have to define if you choose to specify that stationery fees are to be paid at loan disbursement by activating the corresponding option under the menu System/Configuration/Loan Product Settings/Fees. And that case, it is not necessary to define the above GL.

For instance, if the exchange rate of the dollar to the shilling at disbursement of the loan is 1:1000, and at repayment it is 1:2000, a loan repayment of sh. 1050 will be: Rate at repayment / Rate at Disbursement * Repayment amount i.e. 2000 / 1000 * 1050 = 2100. The currency difference shall then be posted on the GL defined here. Linking a loan to a foreign currency is done at loan application under the menu Loans/Loan Application/Loan Entry Part 1.

Fees during application: These are fees levied at loan application.

Note:

1. In the Loan Performer menu "System/Configuration/Loan Product Settings/Fees", you can define the amount and when the loan fees should be levied. This can be at loan application, before approval, after approval or at loan disbursement. You may also tick the corresponding check boxes to make payment of these fees compulsory.

2. When you decide to levy the loan fees before application by specifying the amounts under the menu "System/Configuration/Loan Product Settings/Fees", an additional feature "Loan fees before application"appears in the loans module, otherwise it won't be displayed on the Loan Performer interface.

3. When you decide to levy the loan fees after application by specifying the amounts under the menu "System/Configuration/Loan Product Settings/Fees", an additional feature "Loan fees before approval"appears in the loans module, otherwise it won't be displayed on the Loan Performer interface.

4. When you decide to levy the loan fees before disbursement by specifying the amounts under the menu "System/Configuration/Loan Product Settings/Fees", an additional feature "Loan fees after approval "appears in the loans module, otherwise it won't be displayed on the Loan Performer interface.

5. When you decide to levy the loan fees during disbursement by specifying the amounts under the menu "System/Configuration/Loan Product Settings/Fees", the disbursement screen will appear with the amount specified above, otherwise it won't be displayed on the Loan Performer interface.

Fees during disbursement: These are fees that will be levied at loan disbursement under the menu Loans/Disbursement.

- Stationery: Select a GL account for stationery fees paid at loan disbursement e.g "440072".

- Commission: Select a GL account for commission paid at loan disbursement e.g "420011".

- Mark up: Select the GL account for the mark up e.g "126010". This is the account where the excess amount will be booked when you disburse a loan to a supplier who supplied the goods for which the applicant applied for the loan.

- Development fees: Select a GL account for development fees that are to be paid at loan disbursement e.g "420120".

- Processing fees: Select here the GL account for loan processing fees to be paid at loan disbursement e.g "420100".

Click on the Save command button to save the settings and on the Close command button to quit.

The Nº 1 Software for Microfinance